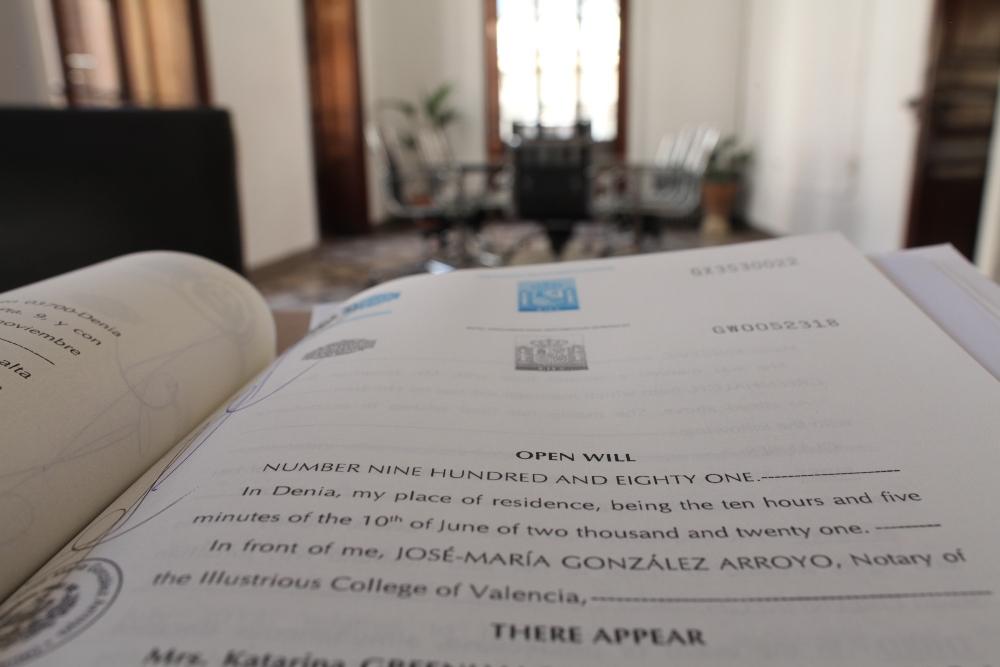

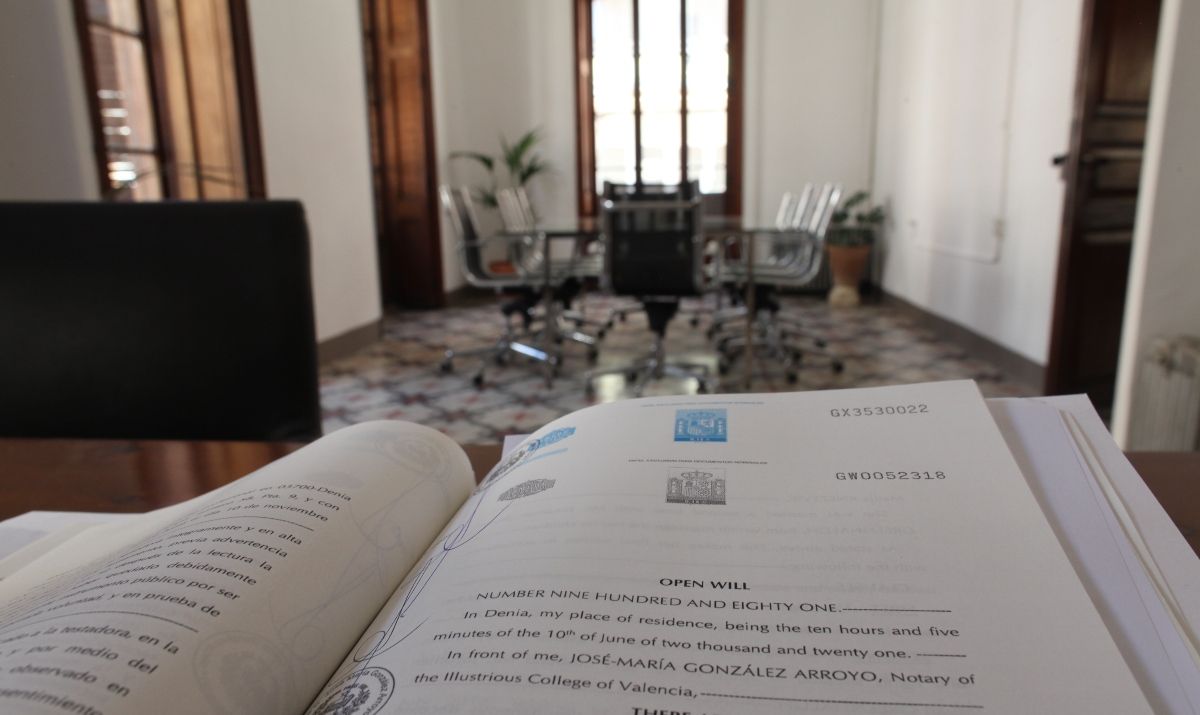

International Inheritance and testaments in Denia Javea and Xativa

Lawyer in Denia, Javea, Xativa » International Inheritance in Denia Javea Xativa Spain

International Inheritance lawyers in Javea, Denia, and Xativa

Our legal services are experienced sine 20 years and specialised in the spanish inheritance of international clients.

Please contact us for specfic information, our work requires study of the corresponding documentation to give you the best legal advice

Specific Information

Information about our services

Contact us for specific information about our services. Our work requires a thorough study of the relevant documentation to ensure optimal management of the inheritance.

Inheritance and Wills Process

The inheritance process is based on the information provided by the beneficiaries of the inheritance. They are responsible for providing information on the assets to be included in the inheritance, values, liabilities and assets.

Inheritance process

At Blanco Abogados, we will help you to manage your inheritance effectively and provide you with the necessary legal advice at every stage of the process.

Beneficiaries

The beneficiaries of the inheritance are responsible for providing the necessary information. In addition, they must also provide information on the values of the inheritance. We make sure to carefully review the documentation provided by the beneficiaries to ensure that all relevant property and assets are included in the inheritance.

Necessary information

Our experienced lawyers can help you research and obtain the missing information to be included in the estate properly.

Responsibility of Blanco Abogados

At Blanco Abogados we ensure that the management of the inheritance is carried out properly, but it is important to bear in mind that we cannot be held responsible if the description of the assets, values or liabilities of the inheritance do not reflect reality.

About the taxes

Basic reductions in the taxes

Reduction for the acquisition of the main residence of the testator.

Box 27. For acquisitions of the main residence of the deceased, enter the 95% reduction on the part of the value of the home included in the taxable base, up to a limit of 122,606.47 euros for each taxpayer, when the purchasers are the spouse, ascendants or descendants of the deceased, or a collateral relative over sixty-five years of age who had lived with the deceased during the two years prior to the death. The application of this reduction shall require that the acquisition be maintained during the ten years following the death of the deceased, unless, in turn, the acquirer dies within this period. In the event of non-compliance with the permanence requirement, the part of the tax which has not been paid and interest on late payment shall be payable.

- 90% if the kinship with the contracting party is that of spouse, ascendant or descendant.

- 50% if the relationship is collateral to the second degree.

- 25% when the relationship is collateral to the third or fourth degree.

- 10% when the relationship is collateral to a more distant degree or when there is no relationship at all.

- Group I. Acquisitions by descendants and adopted children under the age of twenty-one: 15,956.87 euros, plus 3,990.72 euros for each year under the age of twenty-one that the beneficiary has, without the reduction exceeding 47,858.59 euros.

- Group II. Acquisitions by descendants and adoptees aged 21 or over, spouses, ascendants and adoptive parents: 15,956.87 euros.

- Group III. Acquisitions by collateral relatives of the second and third degree, ascendants and descendants by affinity: 7,993.46 euros.

- Group IV. Acquisitions by collaterals of the fourth degree (cousins), more distant degrees and strangers; no reduction is applicable.

- After all the reductions this are the rates

English German and French speaking lawyers availables in Denia, Javea, and Xativa.

We have English, German and French speaking lawyers available in the cities of Denia, Javea and Xativa, to serve our international clients effectively.

LEGAL SERVICES